A retirement advisor reviews and analyzes the client's financial status, annual income, and debts to create a customized retirement plan. This plan is the guideline for client's retirement planning. The advisor may also offer recommendations on various retirement planning products. An advisor will charge a fee to provide this service.

Qualifications for a retirement planner

One of the most important qualifications for a retirement advisor is their ability to manage retirement assets effectively. It is essential to have a solid understanding of the areas of taxation, economics, and retirement planning. Having these credentials can help you establish your credibility and be a valuable asset for clients.

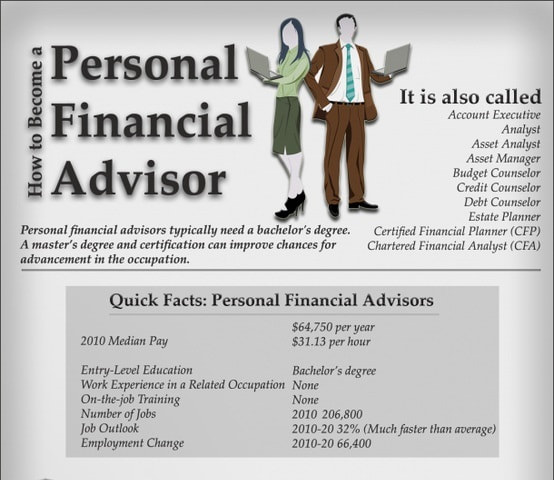

Those who wish to become a retirement advisor should have a bachelor's degree. A degree in finance, business, or a related field is ideal. However, experience is still a great teacher. Many advisors learn their craft through real-world experience. On-the–job training can last for up to a full year for new advisors. This training helps them learn their duties and build a network of clients. They must also complete certification programs that require work experience and additional education.

Cost of a retirement advisor

While each individual's cost of a retirement adviser will vary, there is a general guideline to follow when choosing a professional. Although fees range from $700-$3,500 in general, these fees do not always reflect the actual value of the investments that you buy. Before signing anything, it is important to get a written estimate of the fees. In addition, be sure to ask about whether follow-up meetings are included.

Some advisors charge a flat fee and do not charge assets. Some advisors charge a flat monthly or annual fee. Fee-only advisors charge an initial fee of up to $1,000. The initial fee will be higher because of the work involved, but subsequent meetings should be cheap.

Conflicts in interest when working with a retired advisor

There are risks involved in working with a retirement advisor. Despite the fact that advisors are supposed to act in your best interest, conflicts of interest can arise when financial advisors are receiving back-door payments and hidden fees. They could direct you to low-return, high-cost investments that offer hidden fees that favor Wall Street firms. Clients lose approximately one percentage point annually in their investments as a result.

Conflicts can arise when there are relationships between professionals, organizations and centers with influence. The regulations require advisors to disclose any business affiliations and how they handle conflicts of interest. Conflicts of interest are still allowed, but not prohibited by these guidelines. Good retirement advisors should disclose any financial relationships they have with others.

Time to hire a retirement adviser

An advisor can help you plan your retirement and start your career. A financial advisor can help plan your retirement benefits to avoid financial hardship later. To provide sound advice, the advisor must have the right experience and expertise. You can also get help choosing the right insurance policy and strategies to reduce tax liability.

Interviewing multiple advisors is a great method to find the right one. It may be a good idea to select one who is familiar with working with clients just like you, especially those of color or LGBTQ. You can also ask about the fees and whether they charge by the hour, retainer, or percentage. You should have a written agreement in place with your financial advisor before you hire them.

FAQ

How do I choose a good consultant?

There are three key factors to be aware of:

-

Experience - How many years of experience is this consultant? Is she a beginner, intermediate, advanced, expert, or something else? Is her resume a proof of her skills and knowledge?

-

Education - What did this person learn during school? Did he/she pursue any relevant courses once he/she graduated? Can we see evidence of that learning in the way s/he writes?

-

Personality – Do we like this person/person? Would we prefer him/her working for us?

-

These questions help to decide if the consultant suits our needs. If there are no clear answers, then it might be worth an initial interview to learn more about the candidate.

What is the cost of hiring a consultant?

The cost to hire a consultant depends on many factors. These include:

-

Project size

-

Time frame

-

Scope of work

-

Fees

-

Deliverables

-

Other considerations like experience level, geographical location, etc.

Why would you want to hire consultants?

You might need consultants for a variety of reasons.

-

Your organization may have a specific project or problem that needs solving

-

You want to increase your skills and learn something new

-

You want to work with an expert in a particular field

-

No one else is available to take on the task.

-

You feel overwhelmed with all the information you see and don’t know where it is.

-

You can't afford to pay someone full-time

Referrals are the best way for you to find a qualified consultant. Ask your friends and family if they know of any reliable consultants. If you are already acquainted with someone who works as an advisor, ask them for recommendations.

You can use online directories such as LinkedIn to find consultants in your local area.

How does consulting differ from freelancing?

Freelancers can be self-employed people who provide their services to clients, without the involvement of employees. Hourly rates are usually charged based on the time they spend working on a client’s project. Consultants usually work for agencies or companies that employ them. Their salaries are usually paid monthly or annually.

Because they set their own hours and prices, freelancers are often more flexible than consultants. However, consultants often have better benefits, such as health insurance, vacation days, sick leave, retirement plans, etc.

What qualifications do you need to become a consultant in order to get your degree?

The best way to become an expert on any subject is by studying the subject thoroughly and then practicing what you have learned.

So if you want to learn how to become a great consultant, start studying now!

If you have a degree but no relevant experience, you may struggle to get hired. If you have demonstrated that you have studied the same subjects as those who received the jobs, then you may still be eligible to apply.

Employers are always looking for people with real-world knowledge.

Statistics

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- 67% of consultants start their consulting businesses after quitting their jobs, while 33% start while they're still at their jobs. (consultingsuccess.com)

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

External Links

How To

How to find the best consultant

It is important to first ask yourself what you expect from a consultant when searching for one. You should know exactly what your expectations are before you start searching for someone. Make a list of everything you think you might need from a consultant. This could include: professional expertise and technical skills, project management capabilities, communication skills, availability, etc. Once you have identified your requirements, you might consider asking friends and colleagues to recommend you. Ask them about their experiences with consultants and compare their recommendations to yours. If you don't have any recommendations, try doing some research online. There are many websites, such as LinkedIn, Facebook, Angie's List, Indeed, etc., where people post reviews of their previous work experiences. Look at the ratings and comments left by others and use this data as a starting point for finding potential candidates. Once you have a short list of candidates, contact them to arrange an interview. Talking through your requirements during the interview is a good idea. Ask them questions about how they can assist you in achieving those goals. It doesn't really matter if they were recommended; as long as they understand your business objectives, they will be able to show how they could help you achieve them.